Cost-volume-profit analysis assumes all of the following except, embarking on a journey that unravels the intricacies of this widely used business tool. As we delve into its fundamental principles, assumptions, exceptions, and limitations, we uncover the depths of CVP analysis, empowering you with a comprehensive understanding.

CVP analysis stands as a cornerstone in managerial decision-making, offering invaluable insights into the relationship between costs, volume, and profitability. This introductory paragraph sets the stage for a comprehensive exploration of CVP analysis, establishing its significance and captivating the reader’s attention.

Cost-Volume-Profit (CVP) Analysis: Cost-volume-profit Analysis Assumes All Of The Following Except

Cost-volume-profit (CVP) analysis is a financial tool that helps businesses understand the relationship between costs, volume, and profit. It is used to determine the breakeven point, the point at which a business’s total revenue equals its total costs, and to forecast the impact of changes in volume on profit.

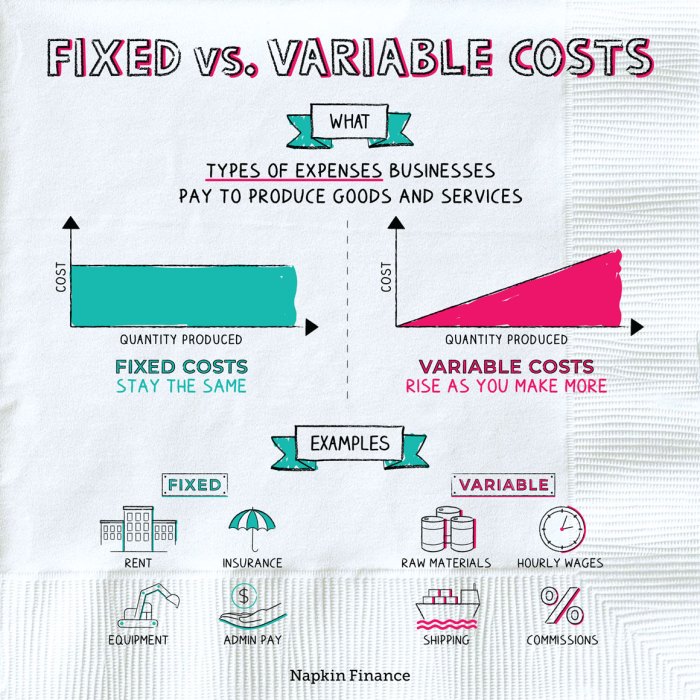

CVP analysis is based on the following assumptions:

- The selling price per unit is constant.

- The variable cost per unit is constant.

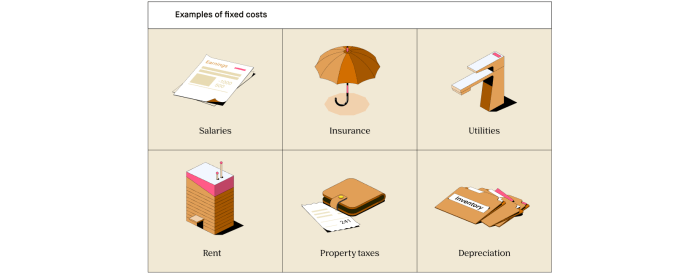

- The fixed costs are constant.

- The volume of sales is the only factor that affects costs and revenues.

These assumptions are often unrealistic, but they allow CVP analysis to be used as a simple and effective tool for financial planning and decision-making.

Exceptions to CVP Assumptions, Cost-volume-profit analysis assumes all of the following except

There are a number of factors that can violate the assumptions of CVP analysis, including:

- Changes in the selling price per unit

- Changes in the variable cost per unit

- Changes in the fixed costs

- Changes in the volume of sales that are not proportional to changes in costs

These factors can impact the accuracy of CVP analysis, so it is important to be aware of them when using this tool.

Limitations of CVP Analysis

CVP analysis has a number of limitations, including:

- It is based on a number of assumptions that may not be realistic.

- It does not take into account all of the factors that can affect costs and revenues.

- It can be difficult to use CVP analysis to forecast the impact of changes in volume on profit.

Despite these limitations, CVP analysis can be a useful tool for financial planning and decision-making. It is a simple and effective way to understand the relationship between costs, volume, and profit.

Applications of CVP Analysis

CVP analysis can be used in a number of ways, including:

- To determine the breakeven point

- To forecast the impact of changes in volume on profit

- To make decisions about pricing and production

- To evaluate the financial performance of a business

CVP analysis is a valuable tool for financial managers and can help businesses make informed decisions about their operations.

Common Queries

What is the primary purpose of CVP analysis?

CVP analysis is primarily used to determine the relationship between costs, volume, and profit, enabling businesses to understand how changes in one factor impact the others.

What are the key assumptions of CVP analysis?

CVP analysis assumes linearity in cost behavior, stability in selling price, and a constant product mix.

What are some exceptions to CVP assumptions?

Exceptions to CVP assumptions include non-linear cost behavior, fluctuating selling prices, and changes in product mix.

What are the limitations of CVP analysis?

CVP analysis is limited by its assumptions and may not accurately reflect real-world scenarios with complex cost structures or market dynamics.